Imagine waking to the news that individuals and businesses with more than $250,000 in deposits at regional banks were withdrawing their assets from their banks. These banks were closing. It’s not difficult to imagine the impact of the panic and fear on the markets and economy. We weren’t as far from that scenario as we’d like. What follows is our take as to how this catastrophe could have happened, how it was avoided, what markets are doing now, and how this event may change the course of the economy. Additionally, we describe some of the protections offered by Charles Schwab.

In the last week, two regional banks have failed, Silicon Valley Bank (SVB) and Signature Bank. These are not especially large banks from an economic viewpoint; but their failure could have led to tragedy.

The FDIC has insured bank deposits for up to $250,000 per account as shown in the nearby image which you may have noticed if you’ve actually set foot in a bank. Depositors up to that amount had no reason to worry about a bank failure. Those with deposits over that limit were in a different boat. When uninsured depositors of SVB became worried about its ability to continue, they started withdrawing funds creating a run on the bank. For brevity and speed, I’m skipping details of the events at SVB. They are well documented and available by search if you like.

Fortunately, the combined policy reaction of the Treasury, the Federal Reserve and FDIC avoided a worse outcome. Secretary of the Treasury Janet L. Yellen, Federal Reserve Board Chair Jerome H. Powell, and FDIC Chairman Martin J. Gruenberg issued a press release saying the Federal Reserve “will make available additional funding to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors.”

For simplicity, we’ll divide banks into large banks which are considered too big to fail and regional banks. By too big to fail, we mean that the government would not let them fail for fear of the impact on the economy. The Dodd–Frank Act imposes heightened supervision standards (including being subject to the annual USA Stress Test) on any bank holding company with a larger than $50 billion balance sheet. These large banks are considered to be systemically important – the belief is that their failure would threaten the financial system and thus the economy.

When SVB failed at the end of last week, it was unclear how much depositors with more than $250,000 would receive and when. If they were not made whole quickly, there might have been runs on many, many regional banks across the country. Their large (over $250,000) depositors might have asked themselves why am I taking the risk of having so much money at this regional bank when I could deposit it at a large, too big to fail, bank?

Banking is important because loans (credit) are important. The impact of many regional bank failures would impact not only the banks themselves, but their individual and business depositors. Think 1929-lite.

Over the weekend, the Treasury, the Federal Reserve and the FDIC announced their support of the banking system. We breathed a sigh of relief and believe this is a good policy. We expect some in Washington will have a different view and it remains to be seen what effect this policy will have over the long term.

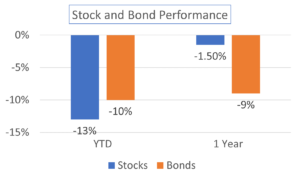

That’s where we are today. How are markets reacting? An index fund of regional bank stocks is down 11% today bringing the loss since the beginning of last week to about 25%. The broad U.S. stock market is flat today. There has been a flight to safety with investors buying Treasury bonds. The U.S. dollar is declining.

Where are we going? We avoid short-term forecasts. We do offer the following ideas on how these recent events will impact the future. Financial stability is a mission of the Federal Reserve. The SVB crisis (and to a certain extent the closure of Signature Bank) threatened that stability. The Federal Reserve has recently been raising rates to reduce inflation. Higher rates made the Treasury bonds purchased by SVB decline in value. We see the Federal Reserve now being more cautious in their inflation fight. In other words, inflation risks are higher and recession risks are lower.

———————————

For our clients with assets at Charles Schwab, we provide the following information.

Unlike deposits at a bank, customer securities-such as stocks and bonds that are fully paid for are segregated from the securities of a broker dealer like Charles Schwab. In the unlikely event of insolvency of a broker dealer, customer segregated assets are not available to the creditors of the broker dealer.

An excerpt from “How client assets are protected at Schwab”: “At Schwab, our customers receive an extra level of coverage. We’ve chosen a program led by Lloyd’s of London, a well-respected name in the insurance industry, as underwriter for additional brokerage insurance. This “excess SIPC” protection of securities and cash is provided up to an aggregate of $600 million, limited to a combined return to any customer from SIPC and Lloyd’s of $150 million, including up to $1,150,000 in cash. This additional protection becomes available in the event that SIPC limits are exhausted and client accounts have not been made whole.”

An excerpt from a missive from Schwab on recent events: “Investments at Schwab are held in investors’ names at the Broker Dealer. Those are separate and not comingled with assets at Schwab’s Bank.” and “Schwab has access to over $80 billion in borrowing capacity with the Federal Home Loan Bank (FHLB), which is an amount greater than all our uninsured deposits. That helps provide the firm significant access to liquidity, so money is there when clients need it.”

The Schwab default sweep for cash is a deposit at Schwab Bank. However, we at Red Tortoise have always preferred purchasing money market mutual funds for their higher interest rate.