If you’re looking for a way to make a lasting difference with your IRA, consider using qualified charitable distributions (QCDs). QCDs are direct donations from your IRA to charities of your choice. Doing this reduces your taxable income, supports a cause you care about, and leaves a legacy that will last beyond your lifetime. In this post, we explain how QCDs work, the benefits and requirements, and unique ways they can support your philanthropic goals.

How They Work

A qualified charitable distribution (QCD) is a direct transfer of funds from your individual retirement account (IRA) to a qualified charity. A QCD can lower your taxable income while satisfying your required minimum distribution (RMD) for the year. To be eligible for a QCD, you must be at least 70½ years old and follow the IRS rules for this type of donation. The maximum annual amount is $100,000 indexed for inflation.

Benefits

In the tax planning arena, there are very few savings vehicles that allow you an income tax deduction upon your contribution, tax free income as it accumulates, and zero income taxes when you take it out. This can all be accomplished with all, or a portion, of a traditional IRA, if the distributions occur after age 70 ½ as QCDs. This makes the most sense for those who have the interest, and the capacity, to direct a portion of their wealth to charity. Consider the following example:

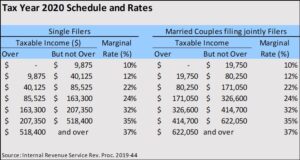

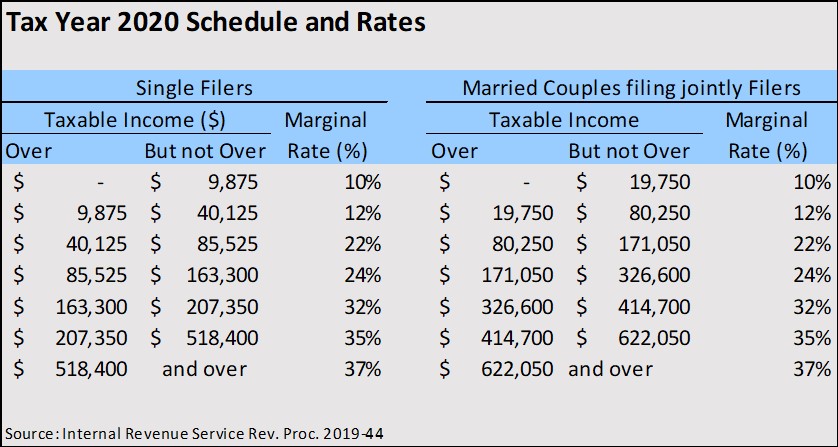

John and Sally Smith are seventy-one years old and have significant assets in IRAs. Their RMD’s exceed $10,000 per year and their marginal tax rate is 30%. John and Sally would like to donate $10,000 to charity each year for the next twenty years. They do not itemize their deductions.

Using QCDs would enable them to donate $200,000 to their favored charities. In contrast, if they were to take the $10,000 directly, pay $3,000 in tax, then the charities would enjoy $140,000 while Uncle Sam pockets the other $60,000.

As the example illustrates, careful planning of the source and timing of your charitable donations can have a big impact.

Requirements

Not all charities are eligible to receive QCDs. Only 501(c)(3) organizations may receive QCDs. This generally includes public charities such as universities, religious organizations and relief organizations like the Red Cross. Some types of 501(c)(3) organizations are excluded. You should particularly note that donor-advised funds (DAFs), and private foundations are not eligible for QCD treatment.

Alternatives to donor-advised funds

There are however three types of charitable funds that resemble donor advised funds and qualify for QCD treatment. These funds are available through community foundations and below is a brief description of each:

- Scholarship funds: These provide financial assistance to students pursuing higher education. The donor can specify the eligibility criteria for the scholarship recipients, such as academic merit, financial need, field of study, or geographic area.

- Designated funds: These support one or more specific charities of the donor’s choice. The donor names the beneficiary charities at the time of establishing the fund.

- Field-of-interest funds: These support a broad area of interest, such as education, health, arts, or environment. The donor does not name specific charities, but rather identifies the specific issues or populations they want to impact.

With each type of fund there are varying degrees of ongoing donor involvement that may be permitted which will vary based on the policies and practices of the sponsoring community foundation.

Summary

Whether you prefer to designate QCD’s to support a charitable cause immediately, or gradually using Scholarship Funds, Designated Funds or Field-of-Interest Funds, they can help you achieve your philanthropic goals in a tax efficient manner. They should be considered along with the various other charitable giving strategies available.

Other Considerations

The most tax efficient ways to satisfy your charitable giving goals will vary based on your unique circumstances. Relevant factors include whether you itemize deductions or take the standard deduction, your current and expected future tax rates, and the availability of low basis, highly appreciated assets.

If you are unsure whether a charity is eligible for QCDs, consult with your tax advisor or the charity itself before making a donation. Keep a record of your QCDs and obtain a written acknowledgment from the charity for each donation. This will help you report your QCDs correctly on your tax return.

QCD’s and donor advised funds (DAFs) can complement each other. While DAFs are not a qualifying charity eligible for QCD treatment, distributions from a DAF can be made to Scholarship Funds, Designated Funds or Field-of-Interest Funds. If you already have a DAF, you can make distributions from both the DAF and the IRA to these three types of funds.

The administrative fees charged by community foundations for an endowment type fund can be as high as 2% per year so you should comparison shop.

Other Sources of Information

For IRS guidelines to QCD’s: https://www.irs.gov/newsroom/seniors-can-reduce-their-tax-burden-by-donating-to-charity-through-their-ira

The largest community foundation in the United States as measured by assets is Silicon Valley Community Foundation. They provide a representative list of giving options that may be available through your local community foundation: https://www.siliconvalleycf.org/donors/charitable-giving-options

For ways of giving via the Community Foundation of Greater Atlanta: https://cfgreateratlanta.org/philanthropists/getting-started/